Beware of pension pirates

Pension scammers want to steal your money. According to the Financial Conduct Authority (FCA), pension scammers swindled people out of more than £30 million between 2017 and 2020.

That’s not all. During 2021 pension scammers got their hands on a further £2 million, with victims losing around £51,000 each on average and the FCA is concerned that the cost-of-living crisis is making people more vulnerable with scammers targeting pension pots.

Make sure it doesn’t happen to you.

The con is always on

Fraudsters will look for any opportunity to con people out of their money, even on National Pension Tracing Day. Follow our top tips to protect your savings.

Spot the scam signs

-

Avoid paid services

It’s not exactly a scam – but watch out for websites that charge you to find lost pensions. You don’t need to pay anyone to trace lost pensions for you. You can do it yourself, free of charge. It’ll take a bit of time and effort, but it could be worth it.

-

Take care with consolidation

If you’re thinking of consolidating your pensions – putting them together to make them easier to manage – remember pension transfers are a popular target for scammers posing as financial advisers. With modern technology, scammers can create professional-looking websites and make attractive-sounding offers to get you to transfer your money to them. Make sure you know who you’re dealing with. Are they on the Financial Conduct Authority (FCA) register of regulated companies – or the FCA warning list of firms that are not authorised or regulated?

Top tips for staying scam smart

-

Ignore unknown contact

It’s best to ignore any contact from out of the blue, especially if they offer a ‘free pension review’. Some scammers claim to be from Government services such as Pension Wise or MoneyHelper, but these organisations won’t contact you unless you contact them first. If it’s someone claiming to be from your bank or building society, contact the bank or building society using their usual contact details. You’ll probably find it wasn’t them.

-

Beware of the ‘rare’

Take care if you are offered a ‘rare’ or ‘one-off’ investment opportunity, particularly if it’s overseas or comes with promises of high or guaranteed returns. Investment returns can’t be guaranteed and moving money overseas makes it harder to trace.

-

Leave the links alone

Beware of links in emails, texts or social media messages – even if they claim to be from your bank, building society, Royal Mail, the NHS, a courier firm or TV Licensing (all current scams). Opening a link can enable scammers to steal your personal details. Worse, you could be downloading viruses or malware on to your device. If you’re not sure whether a message with a link is genuine, look up the sender’s contact details separately, rather than using the link.

-

No loopholes

Watch out for people who claim they can help you exploit pension ‘loopholes’, such as helping you get money out of your pension pot before age 55. Except in rare circumstances such as ill-health, you can’t do this without incurring a tax charge.

-

There’s no rush

If you find yourself being rushed or pressured into making a decision or offered a ‘time-limited’ opportunity, – avoid. Reputable organisations will give you time to think and change your mind.

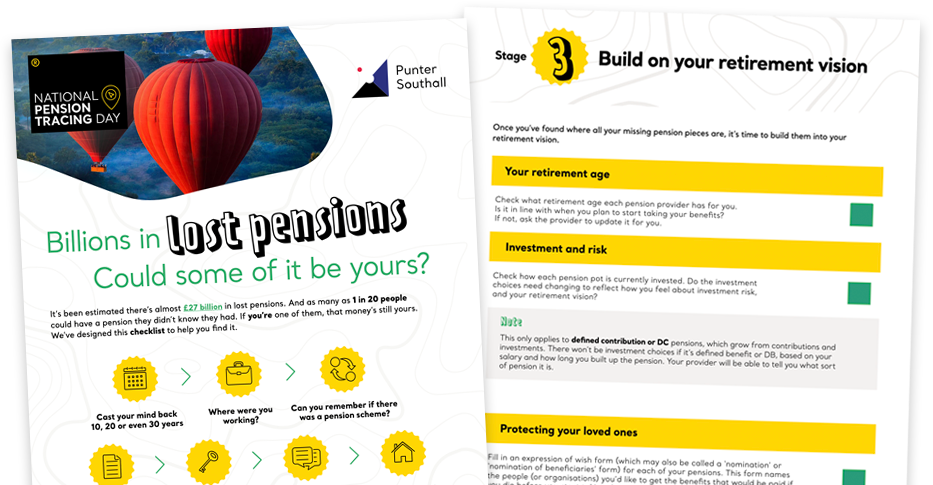

It’s time to trace… let’s go!

Ready to start tracking down your old pension pots? Armed with your scam-smart knowledge, run through our checklist.

Do you have a pension tracing success story?

Tell us about it and inspire others!

Share your journey

Use our hashtags to spread the word on social media. As many as 1 in 20 people could have lost a pension – your friends and family could be among them.

Let’s get pensions trending!