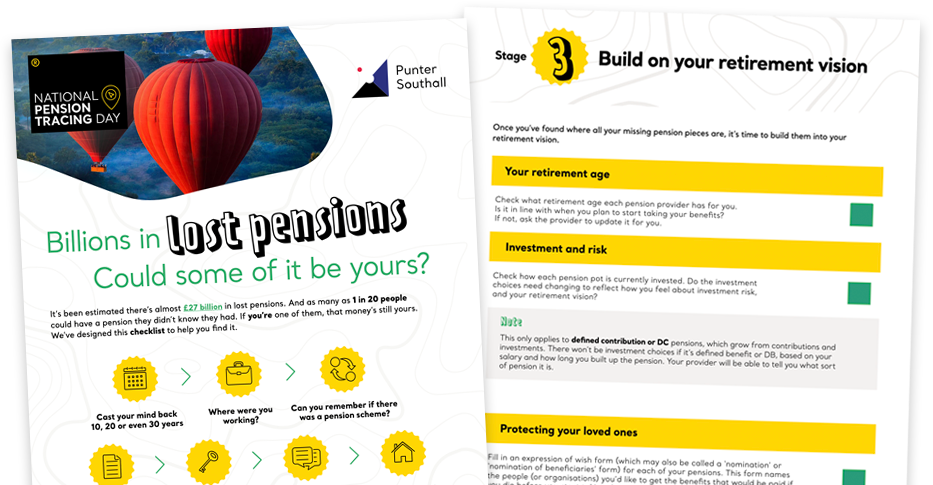

Is there a lost pension with

your name on it?

Cast your mind back 10, 20 or even 30 years. Where were you working? Can you remember if there was a pension scheme? The provider would normally send you a statement every year but…

- How many times have you moved home since then?

- Did you tell your pension providers your new address?

If you forgot, you’re not alone. Most pensions get lost when people move home but don’t remember to give their pension providers their new address.

Track down your lost pensions

with our handy checklist

Go on your own pension safari with our treasure map. You can download and print it and tick off the steps as you work through them.

Five key checkpoints

Checkpoint 1

Retrace your career steps

Head down memory lane. List all the places you’ve worked in the past and roughly how long you worked there. Old CVs, payslips, P45s or P60s may help you.

Checkpoint 2

Search your old papers

Search through your paperwork and emails for old pension statements. Do you have a pension statement for each place you’ve worked at? And did you ever have a separate personal pension? Have a good hunt. Also, can you remember if you ever ‘contracted out’ of part of the State Pension? If you did, there could be a personal pension for you.

(Contracting out was popular in the late 1980s and 1990s. You stopped building up part of the State Pension. In return you either paid lower National Insurance contributions, or some of your National Insurance contributions went into a pension for you. This could have been a workplace or personal pension – so there could be a missing personal pension for you.)

Top

Tip

Take your time. Finding an old pension is like paying yourself money you didn’t know you had – so have a really good look.

Checkpoint 3

Sense check

Are your contact details up to date for each pension pot you’ve got? If they’re not, get in touch with the provider or administrator and update them.

Top

Tip

You can also ask for an up-to-date statement.

Checkpoint 4

Mind the gap

If you’ve spotted any gaps in your pension history, it’s time to do some detective work. For jobs you don’t have a pension statement for, try to find contact details for the pension provider or administrator. You could contact the employer’s HR department directly, or use the government’s Pension Tracing Service.

Top

Tip

If you can’t find your old employer, get online. Employers who have changed their name or merged with another organisation may still show up in a search. Try Companies House – it lists companies’ previous names with their current registered office address. Or, if you worked for a charity, search the Charities Register.

Your employer may have used a personal pension (possibly called a ‘group personal pension’) or a group stakeholder plan as their workplace pension. You’ll need to find the name of the pension provider, perhaps by contacting your old employer, speaking to ex-work colleagues or finding old paperwork.

Checkpoint 5

Get in touch

Now it’s time to get in touch with the provider or administrator and check if they’ve got any record of a pension for you. They’ll need to check you are who you say you are, so you’ll need your National Insurance number and possibly other details – they’ll tell you what they need. It’s also worth asking them to check if you did have a pension with them but transferred it elsewhere.

If they don’t have a record, at least you’ve checked.

If they do have a pension for you:

- find out how much is in the pot and ask for an up-to-date statement

- give them your contact details so they can keep in touch in future

- ask if you can register to access your pension information online, and

- Celebrate! You’ve found treasure.

Top

Tip

Be thorough. Remember, it’s previously been estimated there could be about 2.8 million lost or forgotten pension pots – worth on average £9,500 each. Some of that money could be yours. Check all the details, follow up all the clues.

Build your retirement vision

Once you’ve found where all your missing pension pieces are, it’s time to build them into your retirement vision.

Do you have a pension tracing success story?

Tell us about it and inspire others!

Share your journey

Use our hashtags to spread the word on social media. As many as 1 in 20 people could have lost a pension – your friends and family could be among them.

Let’s get pensions trending!